Worksheet 1 Form 941

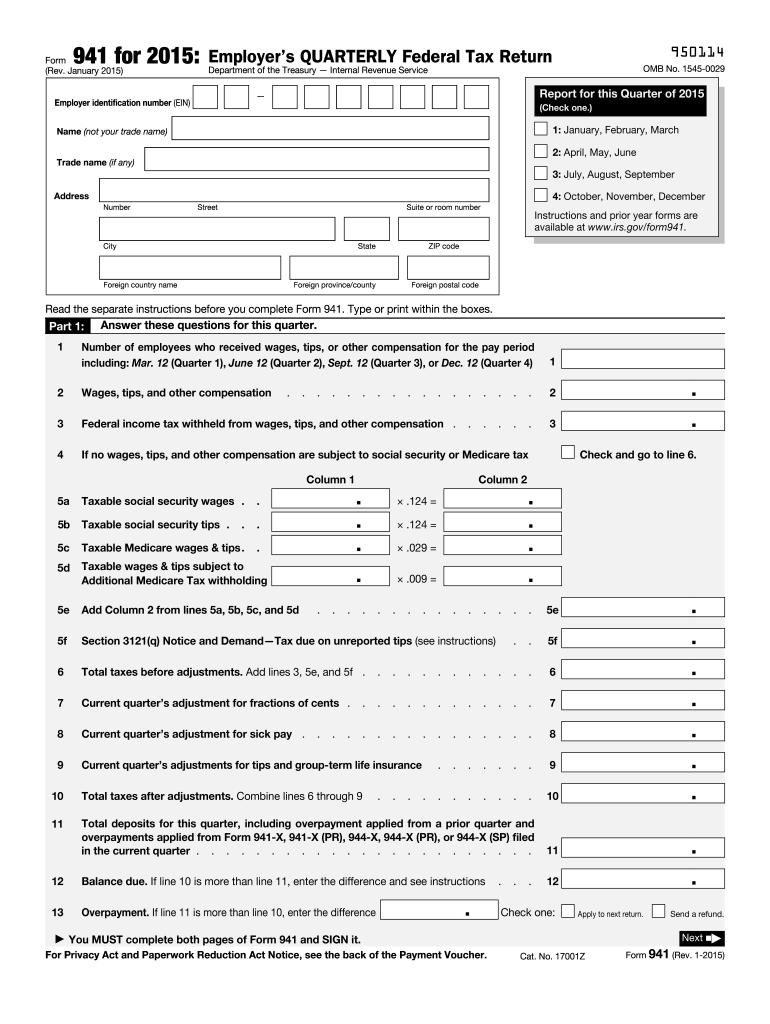

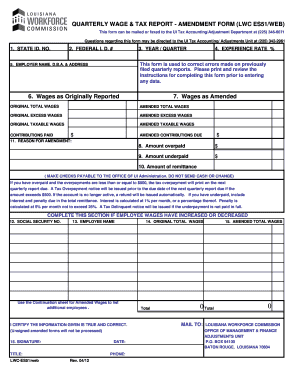

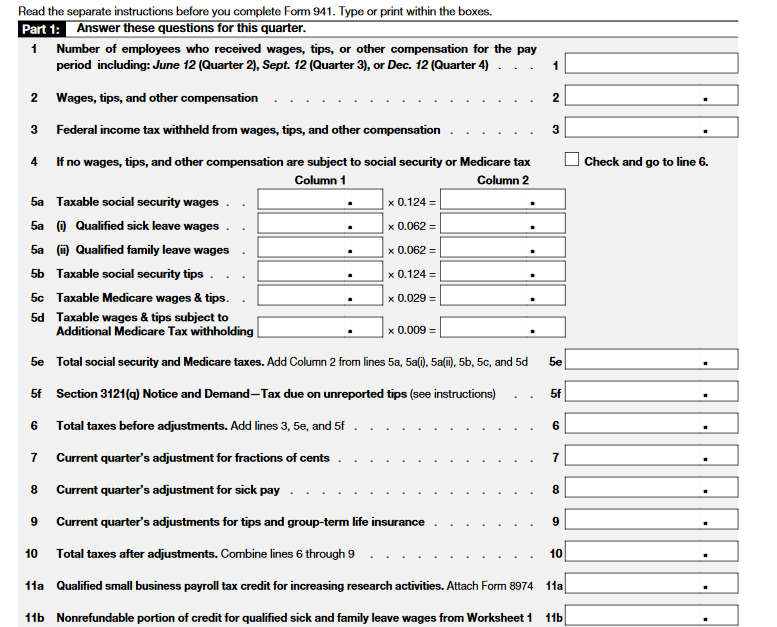

The IRS Form 941 Employers QUARTERLY Federal Tax Return must be filed by employers to report the federal income taxes withheld from employees employee and employer share of social security and Medicare FICA taxes. Use Worksheet 1-2 if you are a dependent for 2021 and for 2020 you had a refund of all federal income tax withheld because of no tax liability.

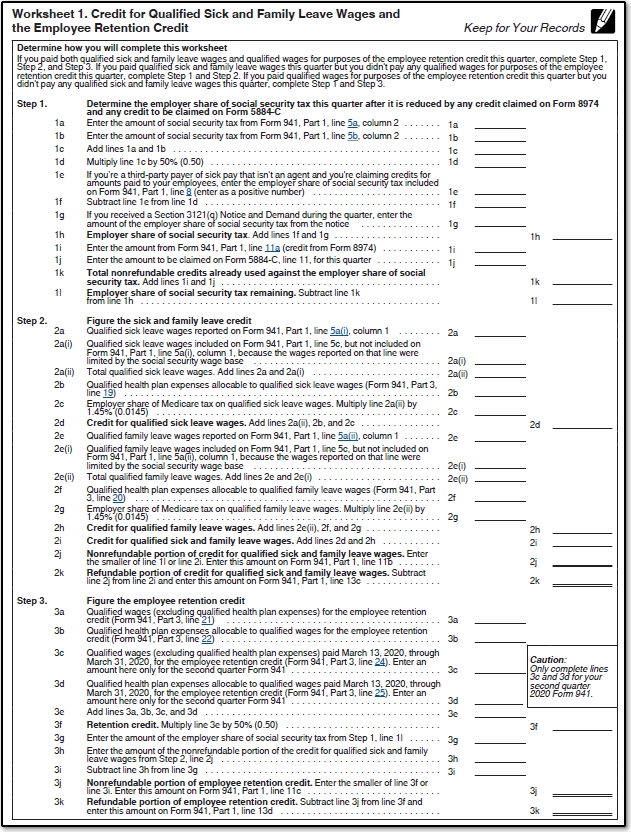

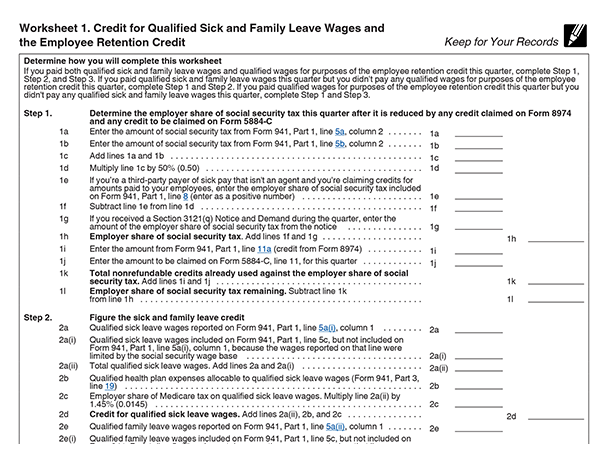

941 Worksheet 1 Credit For Qualified Sick And Family Leave Wages And The Employee Retention Credit Das

The employer should file Form 941 for every quarter.

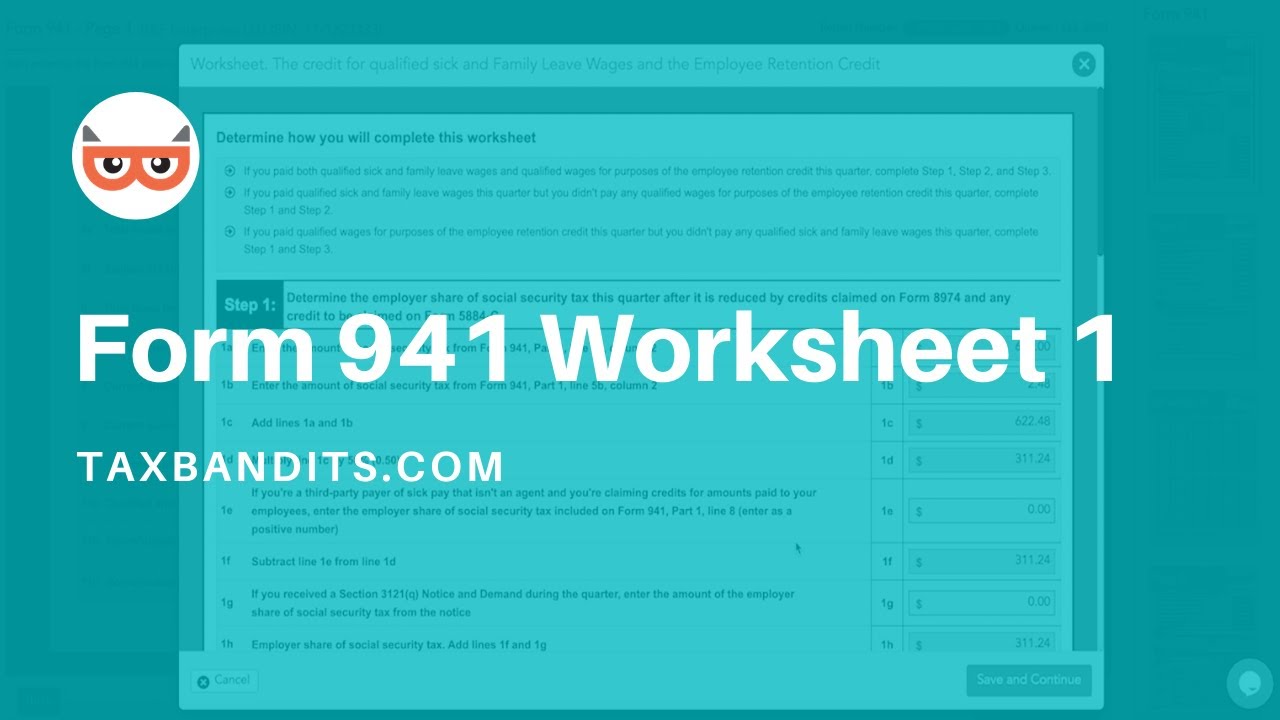

Worksheet 1 Form 941. If you have questions throughout your e-filing process feel free to reach out to our support team. Line 13c - Refundable portion of credit for. Updated on June 14 2021 - 1030 AM by Admin TaxBandits.

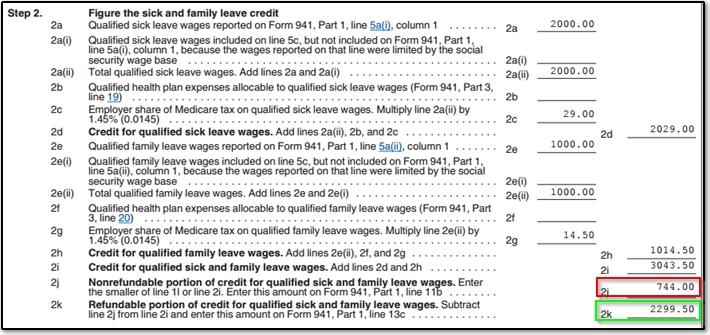

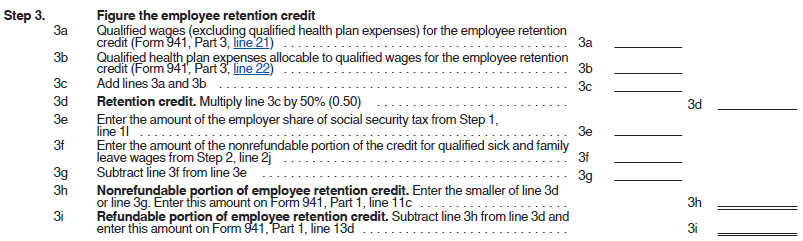

Worksheet 1 in the Instructions for Form 941 can help you calculate your tax refunds and deferments for the qualified Credit for Sick and Family Leave and the Employee Retention Credit. Worksheet 1-3 Projected Tax for 2020. Employers are required to file the revised Form 941 from Quarter 1 for the 2021 tax year.

Below are the topics covered in this article. Partners Instructions for Schedule K-1 Form 1065-B. Now it is reserved for future use.

Employers who file Form 941 Employers QUARTERLY Federal Tax Return must file the revised form with COVID-19 changes from Quarter 2 of 2020Now IRS has revised the Form 941 for Q2 2021 which the filers must use for the second quarter of 2021. Use Worksheet 1-1 if in 2020 you had a right to a refund of all federal income tax withheld because of no tax liability. Employers Quarterly Federal Tax Return.

Use Worksheet 7 instead of Worksheet 6 if you have more than one loss to be reported on different forms or schedules for the same. Complete Worksheet 6 if all the loss from the same activity is to be reported on one form or schedule. Much like with your Form 941 completing Worksheet 1 electronically will help you avoid errors.

Now the IRS has once again revised Form 941 and released a new Form 941 for Quarter 1 2021. Usually Form 941 due date falls by the last day of the month following the reporting quarter. Line 13a - Total deposits for this quarter including overpayment applied from a prior quarter and overpayments applied from Form 941-X 941-X PR 944-X or 944-X SP filed in the current quarter Line 13b - Reserved for future use This was previously used for entering deferred amount of social security tax.

With the second quarter deadline for Form 941 approaching on July 31 2020 now is a great time to begin e-filing your form. The next step is to figure out if you have a balance due or an overpayment. All you need to know about Updated Form 941 Worksheet 1 Q2 2021.

9 4 1 E M P L O Y E E R E T E N T I O N C R E D I T W O R K S H E E T Zonealarm Results

N E W F O R M 9 4 1 2 0 2 0 W O R K S H E E T 1 Zonealarm Results

Https Support Skyward Com Deptdocs Corporate Documentation Public 20website Tutorials Software 1178326 Qtrly Fed Taxreturn 941 Report Pdf

2015 Form Irs 941 Fill Online Printable Fillable Blank Pdffiller

How To Use Form 941 Worksheet 1 And Why Taxbandits Youtube

3 11 13 Employment Tax Returns Internal Revenue Service

941 Worksheet 1 Excel Fill Online Printable Fillable Blank Pdffiller

Form 941 Instructions Line By Line 941 Instruction Explained

Draft Of Revised Form 941 Released By Irs Includes Ffcra And Cares Provisions Current Federal Tax Developments

Https Www Morganlewis Com Media E88fb0dcaadf4a699229f411df239e47 Ashx

Worksheet 1 Can Help You Complete The Revised Form 941 Blog Taxbandits

941 Worksheet 1 Credit For Qualified Sick And Family Leave Wages And The Employee Retention Credit Das

P R I N T A B L E W O R K S H E E T 1 F O R 9 4 1 Zonealarm Results

Forms 941 For 2020 Fill Out And Sign Printable Pdf Template Signnow

941 Worksheet 1 Credit For Qualified Sick And Family Leave Wages And The Employee Retention Credit Das

Completing Your Small Business Taxes With Irs Form 941 The Blueprint

P R I N T A B L E W O R K S H E E T 1 F O R 9 4 1 Zonealarm Results

941 Worksheet 1 Credit For Qualified Sick And Family Leave Wages And The Employee Retention Credit Das

Comments

Post a Comment